Both employees and employers must stay updated and ready for the latest legal advancements as multiple amendments to employment law will be implemented from 6 April 2024.

1) Flexible Working - From 6 April 2024, employees will be able to request flexible working from their first day in a new job. Employers will now have a reduced timeframe of two months, instead of the previous three, to consider and provide a response to the flexible working requests

2) Carers Leave - From 6 April 2024, employees will be entitled to unpaid leave to give or arrange care for a ‘dependent’ who has:

- a physical or mental illness or injury that means they’re expected to need care for more than 3 months

- a disability (as defined in the Equality Act 2010)

- care needs because of their old age.

3) Protection from Redundancy - From April 6, 2024, the redundancy protection will now cover pregnant employees who have not yet started their maternity leave. Additionally, this protection will also apply to individuals who have recently come back to work after maternity leave, as well as those who have returned from adoption leave or at least six weeks of shared parental leave.

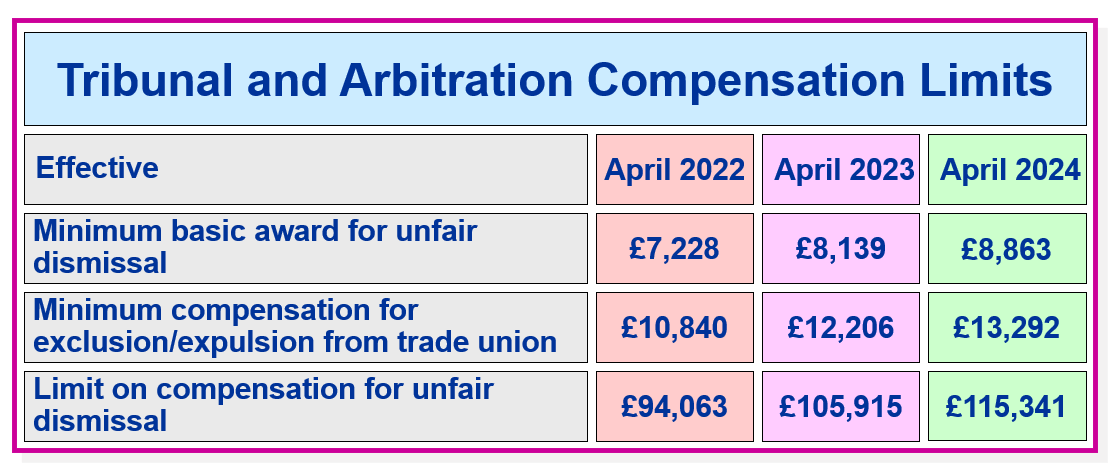

4) Unfair Dismissal - The government has released the updated compensation limits for awards in the employment tribunal and other statutory payments through ‘The Employment Rights (Increase of Limits) Order 2024’ which comes into effect on 6 April 2024. Applies to employees in England, Scotland and Wales

- Maximum compensatory award for unfair dismissal: £105,707 to £115,115.

- The limit on a week’s pay when calculating redundancy pay has been increased from £643 to £700.

- Minimum basic award for certain forms of unfair dismissal has risen from £7,836 to £8,533.

5) Whistleblowing and Discrimination claims - The compensation awarded for injury to feelings, also referred to as the Vento bands, will now range from £1,200 to £58,700, with no maximum limit

6) Statutory Redundancy Pay - Effective April 6, 2024, the maximum weekly amount that can be paid to an employee in England, Scotland, and Wales will increase from £643 to £700.

7) Statutory Sick Pay - The statutory sick pay rate is £109.40 per week, increasing to £116.75 starting on 6 April 2024. This payment can be received for a maximum of 28 weeks. Eligible employees or workers can claim statutory sick pay for the days they would have normally worked, excluding the initial 3 days.

8) Family Leave payments - As of April 6, 2024, the weekly rates for statutory maternity pay, paternity pay, adoption pay, shared parental pay, and parental bereavement pay will increase from GBP 172.48 to GBP 184.03.

9) National Minimum Wage - The NLW rate for 2024 stands at £11.44, representing a 10% rise in monetary value compared to the 2023 NLW (£10.42). The age for NLW is reduced from 23 to age 21 and over.

10) Northern Ireland Employment Law Payments and Awards from April 2024